Transfer-on-Death Deed Document for California State

Things You Should Know About This Form

What is a California Transfer-on-Death Deed?

A California Transfer-on-Death Deed is a legal document that allows a property owner to transfer real estate to a designated beneficiary upon the owner's death. This deed provides a straightforward way to pass on property without the need for probate, making the process simpler and often more cost-effective for heirs.

Who can use a Transfer-on-Death Deed in California?

Any individual who owns real estate in California can utilize a Transfer-on-Death Deed. It is important to note that the property must be solely owned by the individual and not jointly owned or part of a trust. This deed is particularly beneficial for homeowners looking to ensure a smooth transition of their property to loved ones.

How do I create a Transfer-on-Death Deed?

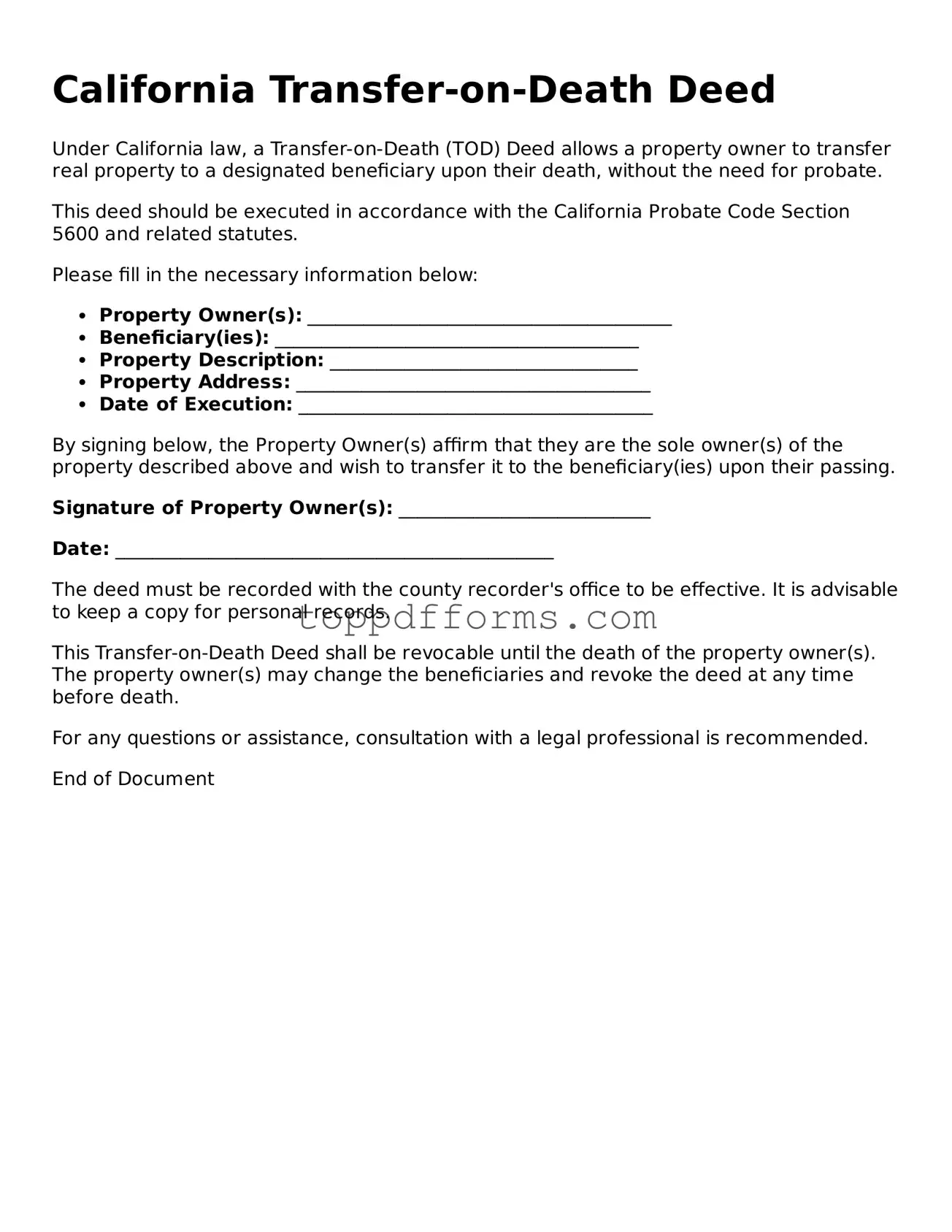

To create a Transfer-on-Death Deed, you must complete a specific form provided by the California state government. This form requires details such as the property description, the owner's information, and the beneficiary's information. Once completed, the deed must be signed and notarized before being recorded with the county recorder's office where the property is located.

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be fees associated with recording the Transfer-on-Death Deed. Each county in California has its own fee structure, so it is advisable to check with the local county recorder's office for the exact amount. Additionally, while there are no tax implications at the time of transfer, beneficiaries may need to consider property taxes once they inherit the property.

Can I change or revoke a Transfer-on-Death Deed after it has been created?

Absolutely. A Transfer-on-Death Deed can be revoked or modified at any time before the owner's death. To do this, the owner must create a new deed that explicitly revokes the previous one or file a revocation form with the county recorder's office. This flexibility allows property owners to adjust their plans as circumstances change.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed becomes void. In such cases, the property owner may want to update the deed to name a new beneficiary. It is essential to keep the deed current to ensure that the property passes to the intended heir.

Are there any limitations on the type of property that can be transferred using this deed?

Yes, there are limitations. The Transfer-on-Death Deed can only be used for residential real estate, such as single-family homes or condominiums. It cannot be used for commercial properties, timeshares, or properties held in a business entity. Understanding these limitations is crucial for effective estate planning.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney assist with the creation of a Transfer-on-Death Deed, consulting one can be beneficial. An attorney can provide guidance tailored to your specific situation and ensure that the deed complies with California laws, helping to avoid potential pitfalls.

Will a Transfer-on-Death Deed affect my ability to sell or mortgage the property during my lifetime?

No, a Transfer-on-Death Deed does not affect the owner's rights to sell, mortgage, or otherwise manage the property during their lifetime. The owner retains full control over the property until death, allowing for flexibility in financial decisions while still planning for the future transfer of the property.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by California Probate Code Section 5600-5690. |

| Revocation | Property owners can revoke or change the deed at any time before their death, ensuring flexibility in estate planning. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them as specified in the deed. |

| Filing Requirements | The deed must be recorded with the county recorder's office where the property is located to be effective. |

Common mistakes

When filling out the California Transfer-on-Death Deed form, many individuals make mistakes that can lead to complications down the line. One common error is failing to properly identify the property. It's crucial to provide a complete legal description of the property, not just the address. Omitting details can create confusion and may result in legal disputes.

Another frequent mistake involves not naming the beneficiaries correctly. If a beneficiary's name is misspelled or if their relationship to the property owner is unclear, this can cause issues. It’s important to double-check names and ensure they match official documents. This simple step can prevent problems during the transfer process.

People also often forget to sign and date the form. A Transfer-on-Death Deed is not valid without the owner's signature. Additionally, the date is essential for establishing when the deed was executed. Without these, the deed may be considered incomplete and unenforceable.

Some individuals neglect to have the deed notarized. In California, notarization is a necessary step to ensure the deed is legally binding. Skipping this step can lead to the deed being challenged later, complicating the transfer process for beneficiaries.

Lastly, individuals sometimes fail to record the deed with the county recorder's office. Simply filling out the form is not enough. Recording the deed is what makes it effective and official. Without this step, the transfer may not be recognized, leaving beneficiaries without the intended property.

Other Common State-specific Transfer-on-Death Deed Forms

Survivorship Deed Vs Transfer on Death - For married couples, both owners can utilize separate Transfer-on-Death Deeds for their respective interests.

Assent to Devise - This deed form simplifies the transfer of property, ensuring a smoother transition while retaining control during the owner's lifetime.

Understanding the details of the transaction is essential, and utilizing a reliable resource can make the process smoother; for instance, you can access the necessary documents through PDF Templates to ensure you have everything required for the Texas Real Estate Purchase Agreement form.

How to Transfer a Property Deed From a Deceased Relative in Florida - The property remains in the original owner's name until their death, giving them full control during their lifetime.

Problems With Transfer on Death Deeds in Virginia - The deed allows for flexibility in estate planning, as it can be changed or revoked at any time.