Loan Agreement Document for Georgia State

Things You Should Know About This Form

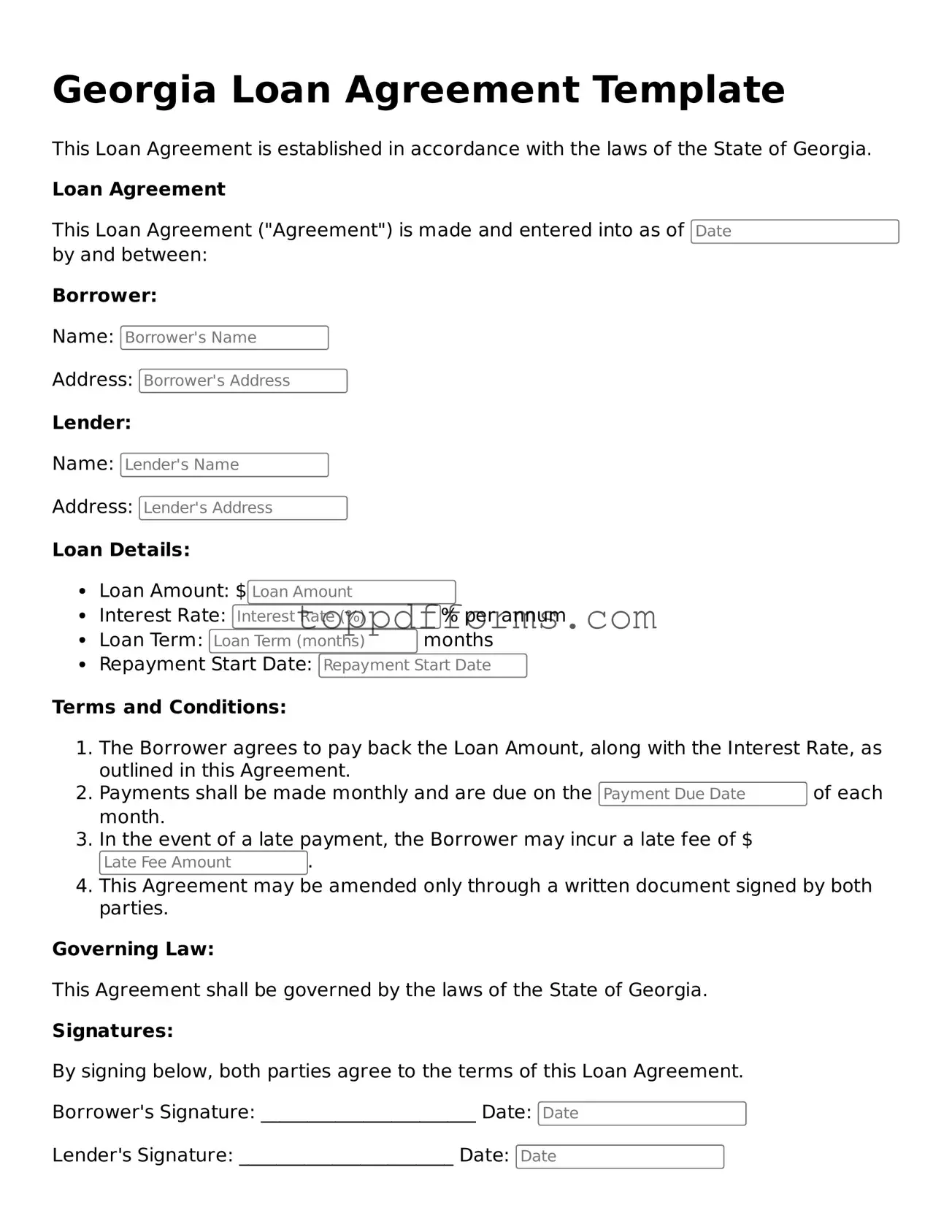

What is a Georgia Loan Agreement form?

A Georgia Loan Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan to a lender. This form is essential for defining the relationship between the two parties and ensuring that both understand their rights and obligations.

Who can use a Georgia Loan Agreement?

Any individual or entity that is lending money can use a Georgia Loan Agreement. This includes banks, credit unions, private lenders, and even friends or family members. The agreement helps formalize the loan and protects both the lender's and borrower's interests.

What information is typically included in the form?

The form usually includes details such as the names of the borrower and lender, the loan amount, interest rate, repayment schedule, and any collateral that may be required. Additionally, it may outline the consequences of defaulting on the loan and any fees associated with late payments.

Is it necessary to have a written agreement?

While verbal agreements can be legally binding, having a written agreement is highly recommended. A written Georgia Loan Agreement provides clear evidence of the terms and can prevent misunderstandings or disputes in the future. It also serves as a legal document that can be presented in court if necessary.

Can the terms of the loan be modified after the agreement is signed?

Yes, the terms of the loan can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to ensure clarity and enforceability.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may take several actions as outlined in the agreement. This could include pursuing legal action to recover the owed amount, seizing collateral if applicable, or negotiating a new repayment plan. The specific consequences should be clearly stated in the agreement.

Are there any legal requirements for a Georgia Loan Agreement?

Yes, certain legal requirements must be met for a Georgia Loan Agreement to be enforceable. For instance, the agreement should be clear and unambiguous, and it should comply with state laws regarding interest rates and lending practices. It is wise to consult a legal professional to ensure compliance.

Is there a specific format for the Georgia Loan Agreement?

While there is no mandated format, the agreement should be clear and organized. It is beneficial to use headings and bullet points to make the document easy to read. Including a date and signatures from both parties is essential for validation.

Can a Georgia Loan Agreement be used for personal loans?

Absolutely. A Georgia Loan Agreement can be used for personal loans between individuals, such as loans between friends or family members. It helps to formalize the arrangement and set clear expectations for repayment.

Where can I find a Georgia Loan Agreement template?

Templates for Georgia Loan Agreements can be found online through legal websites, or they can be drafted by legal professionals. It is important to choose a template that is tailored to Georgia law and to customize it to fit the specific terms of the loan.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | The Georgia Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Georgia. |

| Loan Amount | The form specifies the total amount of money being loaned to the borrower. |

| Interest Rate | The agreement includes the interest rate applicable to the loan, which must comply with Georgia's usury laws. |

| Repayment Terms | Details about how and when the borrower will repay the loan are clearly outlined in the form. |

| Signatures | Both the lender and the borrower must sign the agreement for it to be legally binding. |

Common mistakes

Completing the Georgia Loan Agreement form requires attention to detail. One common mistake is failing to provide accurate personal information. Borrowers must ensure that their names, addresses, and contact details are correct. Any discrepancies can lead to delays in processing the loan or even rejection of the application.

Another frequent error involves the omission of necessary financial information. Applicants often forget to include their income, employment details, or existing debts. This information is crucial for lenders to assess the borrower's ability to repay the loan. Incomplete financial disclosures can raise red flags and hinder the approval process.

Many individuals also overlook the importance of reading the terms and conditions carefully. Some may sign the agreement without fully understanding the obligations and consequences. This can result in unexpected fees or unfavorable loan terms. It is essential to comprehend all aspects of the agreement before proceeding.

Lastly, neglecting to review the document for errors is a significant mistake. Typos or incorrect figures can create misunderstandings between the borrower and lender. Taking the time to proofread the agreement can prevent complications and ensure a smoother transaction.

Other Common State-specific Loan Agreement Forms

New York Promissory Note - The agreement aims to minimize disputes by providing a clear framework for the loan's terms.

To ensure a smooth rental process, it is recommended that you familiarize yourself with a Rental Application form, which serves as a critical tool for both tenants and landlords. By effectively providing details about your financial stability and rental history, you can improve your application. For convenient access to the necessary paperwork, check out the available PDF Templates to help guide you through this process.

Loan Note Template - Encourages thorough review before signing to ensure comprehension.