Promissory Note Document for Georgia State

Things You Should Know About This Form

What is a Georgia Promissory Note?

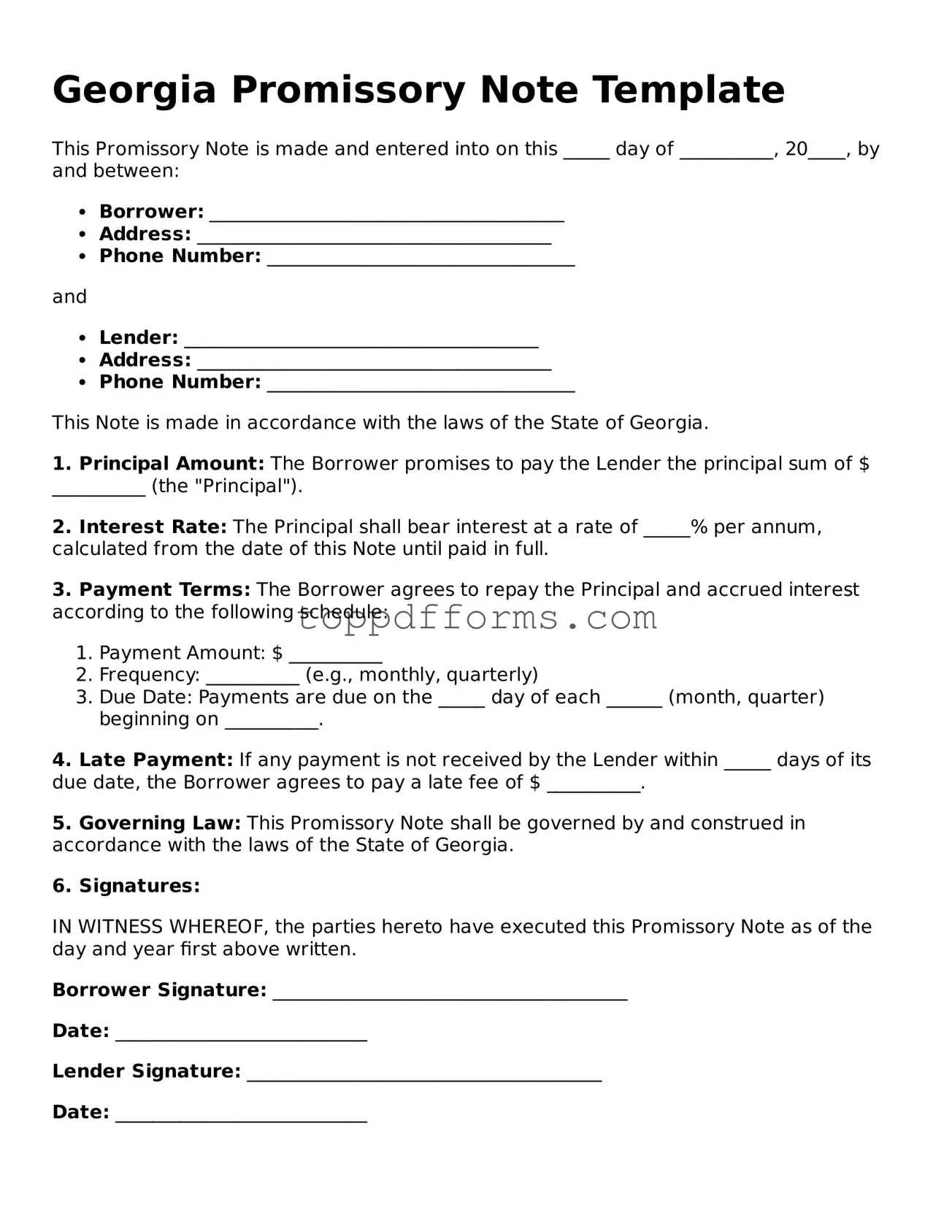

A Georgia Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. It serves as a written record of the loan and includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved.

Who can use a Promissory Note in Georgia?

Any individual or business in Georgia can use a Promissory Note. It is commonly used in personal loans, business loans, and real estate transactions. Both the borrower and lender should be clear about the terms to ensure mutual understanding and enforceability.

What should be included in a Georgia Promissory Note?

A comprehensive Georgia Promissory Note should include the following elements: the names and addresses of both the borrower and lender, the principal amount of the loan, the interest rate, the repayment schedule, any late fees or penalties, and the signatures of both parties. Including a clause for default and remedies can also be beneficial.

Is a Georgia Promissory Note legally binding?

Yes, a Georgia Promissory Note is legally binding as long as it meets the necessary requirements. Both parties must agree to the terms, and the document should be signed and dated. If disputes arise, the note can be enforced in court, provided it is properly executed.

Do I need to have a lawyer to create a Promissory Note in Georgia?

While it is not required to have a lawyer draft a Promissory Note, consulting with one can help ensure that the document complies with Georgia laws and adequately protects both parties' interests. A legal professional can also assist in addressing any specific concerns or complexities related to the transaction.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to avoid future disputes.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing collection methods. The specific remedies available will depend on the terms outlined in the Promissory Note and applicable Georgia laws.

Are there any tax implications for using a Promissory Note in Georgia?

Yes, there can be tax implications associated with a Promissory Note. For example, the lender may need to report interest income on their tax returns, while the borrower may not be able to deduct interest payments unless certain conditions are met. It is advisable to consult a tax professional for guidance tailored to individual circumstances.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Georgia Promissory Note is a written promise to pay a specific amount of money to a designated person at a specified time. |

| Governing Law | The laws governing promissory notes in Georgia are found in the Official Code of Georgia Annotated (O.C.G.A.) Title 11, which deals with commercial transactions. |

| Essential Elements | To be valid, a promissory note must include the amount owed, the interest rate (if applicable), the due date, and the signatures of the parties involved. |

| Enforceability | A properly executed promissory note is legally enforceable in Georgia, meaning the lender can take legal action if the borrower fails to repay. |

| Types | There are various types of promissory notes, including secured and unsecured notes, which differ based on whether collateral is involved. |

Common mistakes

When individuals fill out the Georgia Promissory Note form, several common mistakes can lead to complications later on. One frequent error is failing to include all required information. The form typically requires specific details such as the names of the borrower and lender, the amount of the loan, and the interest rate. Omitting any of this information can render the note invalid or unenforceable.

Another mistake is not clearly stating the repayment terms. The repayment schedule should be explicitly outlined. If a borrower does not specify whether payments will be made monthly, quarterly, or annually, confusion may arise. This lack of clarity can lead to disputes between the parties involved.

Additionally, individuals often overlook the importance of signatures. A Promissory Note must be signed by both the borrower and the lender to be legally binding. Without these signatures, the document may not hold up in court if a dispute arises. It is essential to ensure that all parties involved have signed the document before considering it finalized.

Finally, failing to keep a copy of the completed form is a mistake that many make. It is crucial for both parties to retain a copy of the signed Promissory Note for their records. This documentation serves as proof of the agreement and can be invaluable in the event of any future disagreements regarding the terms of the loan.

Other Common State-specific Promissory Note Forms

Promissory Note Template California - In some cases, a witness may be required to sign the note to validate it.

New York Promissory Note Requirements - A well-drafted promissory note should include the borrower's contact information.

When engaging in the sale of a vehicle, it is crucial to utilize a Texas Motor Vehicle Bill of Sale, which serves as a vital legal record for the transaction. This document not only facilitates the ownership transfer but also meets the necessary state regulations for vehicle registration. For an easy way to access this important form, you can find it among various PDF Templates designed to assist both buyers and sellers in ensuring a seamless process.

Create Promissory Note - Payment frequency, such as monthly or quarterly, will be stated in the agreement.