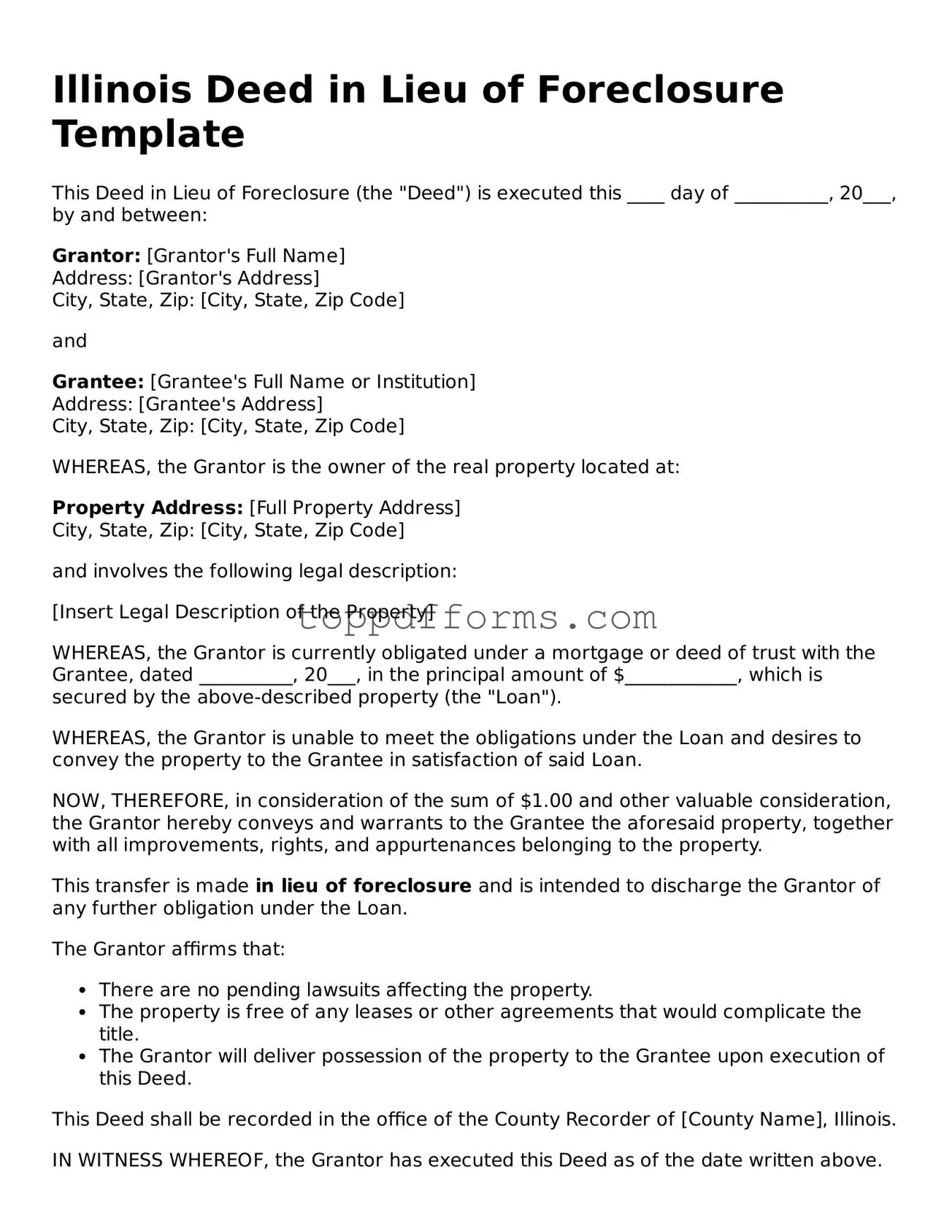

Deed in Lieu of Foreclosure Document for Illinois State

Things You Should Know About This Form

What is a Deed in Lieu of Foreclosure in Illinois?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. This process can be a beneficial alternative for homeowners facing financial difficulties, as it helps them avoid the lengthy and often stressful foreclosure process. By opting for a deed in lieu, the homeowner can potentially protect their credit score and may be able to negotiate the terms of their mortgage debt with the lender.

Who is eligible to use a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure typically depends on the lender's policies, but generally, homeowners facing financial hardship, such as job loss or medical expenses, may qualify. It is essential to demonstrate that you cannot continue making mortgage payments and that foreclosure is imminent. Additionally, the property must be free of other liens or encumbrances, or the lender must agree to accept the deed despite these issues.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can offer several benefits. Homeowners can avoid the lengthy foreclosure process, which can take months or even years. This option may also help minimize the damage to your credit score compared to a foreclosure. Furthermore, it can provide a fresh start, allowing you to move on without the burden of an unpaid mortgage. Some lenders may even offer relocation assistance to help you transition to new housing.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure can be beneficial, it is essential to consider the potential drawbacks. The lender may still pursue a deficiency judgment for the remaining mortgage balance if the property is worth less than the amount owed. Additionally, some homeowners may feel a sense of loss or failure when giving up their home, which can be emotionally challenging. It is crucial to weigh these factors carefully and consult with a financial advisor or attorney before proceeding.

How do I initiate the Deed in Lieu of Foreclosure process?

To initiate the Deed in Lieu of Foreclosure process, start by contacting your lender to discuss your situation. Be prepared to provide financial documentation that demonstrates your inability to continue making mortgage payments. If the lender agrees to consider this option, they will typically require you to complete specific forms and may conduct a property appraisal. Once all conditions are met, the deed will be drafted and signed, officially transferring ownership.

Will I be responsible for any taxes after completing a Deed in Lieu of Foreclosure?

In some cases, homeowners may face tax implications after completing a Deed in Lieu of Foreclosure. The IRS may consider the forgiven debt as taxable income, meaning you could owe taxes on the amount that was forgiven. However, the Mortgage Forgiveness Debt Relief Act provides some exemptions for certain situations. It is advisable to consult a tax professional to understand your specific circumstances and potential tax liabilities.

Can I still apply for a new mortgage after completing a Deed in Lieu of Foreclosure?

While it is possible to apply for a new mortgage after completing a Deed in Lieu of Foreclosure, it may be challenging. Lenders typically impose waiting periods before you can qualify for a new loan, which can range from two to seven years, depending on the lender's policies and your credit history. During this time, it is essential to rebuild your credit and demonstrate financial stability to improve your chances of securing a new mortgage.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | An Illinois Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender to avoid foreclosure. |

| Governing Laws | This form is governed by the Illinois Compiled Statutes, specifically under 735 ILCS 5/15-1401. |

| Benefits | It can help homeowners avoid the lengthy foreclosure process, reduce the impact on their credit score, and allow for a smoother transition away from the property. |

| Considerations | Homeowners should ensure they understand the implications of signing this deed, as it may affect their ability to obtain future loans and may not relieve them of all liabilities associated with the mortgage. |

Common mistakes

Filling out the Illinois Deed in Lieu of Foreclosure form can be a daunting task. Many individuals make common mistakes that can lead to delays or complications in the process. One prevalent error is failing to provide accurate property information. The form requires precise details about the property, including the legal description and address. Omitting or misreporting this information can cause significant issues during the transfer process.

Another mistake often encountered is neglecting to include all necessary signatures. The form mandates signatures from all parties involved in the transaction. If even one signature is missing, it may render the deed invalid. It is crucial to ensure that all owners or interested parties sign the document before submission.

People also frequently overlook the requirement for notarization. A deed in lieu of foreclosure must be notarized to be legally binding. Failing to have the document notarized can lead to challenges in enforcing the deed later on. This step is essential for validating the authenticity of the signatures and the intent of the parties involved.

Lastly, individuals sometimes misinterpret the implications of the deed. A Deed in Lieu of Foreclosure does not automatically absolve the borrower from all liabilities. Understanding the potential tax consequences and impact on credit is vital. Consulting with a financial advisor or attorney can provide clarity on these issues, ensuring that all parties are fully informed before proceeding.

Other Common State-specific Deed in Lieu of Foreclosure Forms

California Property Surrender Deed - This process can also help expedite the recovery of local real estate markets.

When conducting a transaction, it’s crucial to have a reliable document to validate the sale; for this reason, using a Texas Bill of Sale is essential. This form outlines the details of the exchange, such as the items involved, purchase price, and the identities of both the buyer and seller. To simplify the process, consider utilizing resources such as PDF Templates which can assist you in drafting the necessary documentation accurately.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - This document can enhance the chance of a smoother transition for the homeowner and the lender alike.