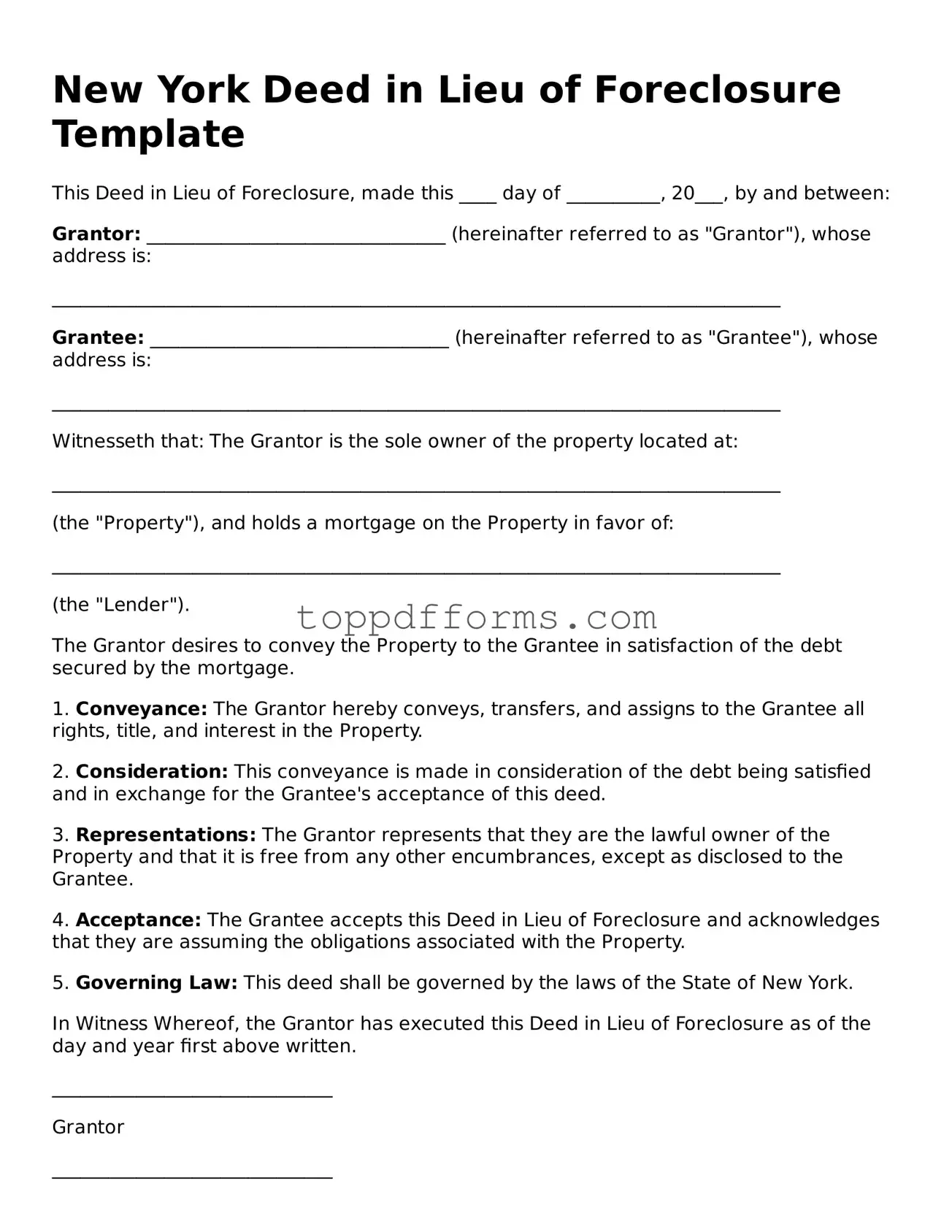

Deed in Lieu of Foreclosure Document for New York State

Things You Should Know About This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid the foreclosure process. This option is often considered when a homeowner is struggling to keep up with mortgage payments and wants to minimize the impact on their credit score. By agreeing to this arrangement, the lender typically agrees to release the homeowner from the mortgage obligation, thus providing a more amicable resolution to a difficult financial situation.

What are the benefits of opting for a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can offer several advantages. First, it can help you avoid the lengthy and stressful foreclosure process. This can save you time, money, and emotional distress. Additionally, it may have a less severe impact on your credit score compared to a foreclosure. Many lenders also provide financial assistance or relocation benefits to help you transition after the deed is transferred. Furthermore, it can provide a fresh start, allowing you to move on from the burdens of an unaffordable mortgage.

What are the potential downsides of a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential downsides to consider. One significant concern is that a Deed in Lieu of Foreclosure may still negatively impact your credit score, though typically less than a foreclosure. Additionally, not all lenders accept this option, and some may require you to prove that you have exhausted all other alternatives. There may also be tax implications, as the IRS could view the forgiven debt as taxable income. It’s important to consult with a financial advisor or tax professional to fully understand the ramifications.

How do I initiate the process for a Deed in Lieu of Foreclosure?

To start the process, you should first contact your lender and express your interest in a Deed in Lieu of Foreclosure. They will likely require you to provide documentation regarding your financial situation, including income, expenses, and any other relevant information. After reviewing your situation, the lender may conduct an appraisal of the property. If they agree to the deed transfer, you will need to sign the necessary paperwork, and the lender will typically take care of the rest. Remember, it’s wise to seek legal advice to ensure you understand all aspects of the agreement before proceeding.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | New York Real Property Actions and Proceedings Law (RPAPL) governs the process and requirements for deeds in lieu of foreclosure in New York. |

| Eligibility | Borrowers must demonstrate financial hardship and be unable to continue making mortgage payments to qualify for a deed in lieu of foreclosure. |

| Benefits | This option can provide a faster resolution than foreclosure and may have less impact on the borrower’s credit score. |

| Considerations | Borrowers should consult with legal and financial advisors to understand the implications, including potential tax consequences and the impact on future borrowing. |

Common mistakes

When completing the New York Deed in Lieu of Foreclosure form, many individuals make common mistakes that can complicate the process. One frequent error is failing to provide accurate property information. This includes the legal description of the property, which must match the records held by the county. Inaccuracies can lead to delays or even rejection of the deed.

Another mistake involves not obtaining the necessary signatures. All parties with an interest in the property must sign the deed. This includes co-owners or anyone with a lien on the property. Omitting a signature can invalidate the document and prolong the foreclosure process.

People often overlook the importance of including a proper date on the form. The date signifies when the deed is executed and can affect the timeline of the foreclosure. Without a date, the deed may be considered incomplete, leading to further complications.

Lastly, many individuals neglect to seek legal advice before submitting the deed. While the form may seem straightforward, understanding the implications of signing a deed in lieu of foreclosure is crucial. Legal guidance can help avoid potential pitfalls and ensure that all requirements are met.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Georgia Foreclosure Laws - It is essential to consider seeking legal advice before signing the deed.

The Texas Motor Vehicle Power of Attorney form is crucial for individuals who need to delegate authority for vehicle-related transactions. By filling out this legal document, one can ensure that their vehicle matters are handled competently, even in their absence. For those seeking to complete this form, resources like PDF Templates can provide the necessary guidance and templates to streamline the process.

Deed in Lieu of Mortgage - A mechanism for reducing the lengthy process typically associated with foreclosure.

Will I Owe Money After a Deed in Lieu of Foreclosure - Both the borrower and lender must sign the deed for it to be legally binding.