Durable Power of Attorney Document for New York State

Things You Should Know About This Form

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney is a legal document that allows you to appoint someone to make financial and legal decisions on your behalf. Unlike a regular Power of Attorney, the durable version remains effective even if you become incapacitated. This ensures that your financial matters can be managed without interruption during difficult times.

Who can be appointed as an agent in a Durable Power of Attorney?

You can choose almost anyone to be your agent, as long as they are at least 18 years old and mentally competent. Common choices include family members, trusted friends, or financial advisors. It’s essential to select someone you trust completely, as they will have significant control over your financial affairs.

How does one create a Durable Power of Attorney in New York?

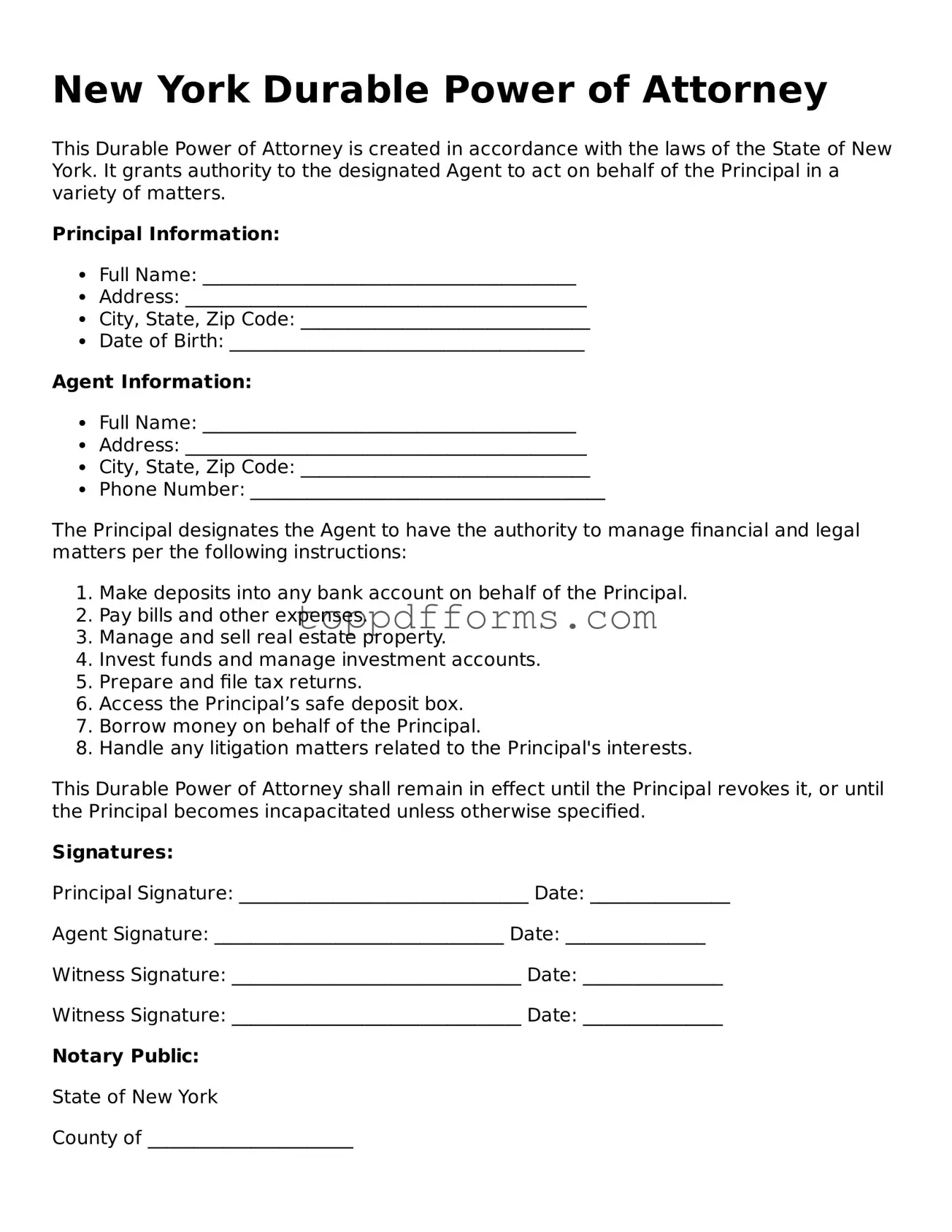

To create a Durable Power of Attorney in New York, you must complete a specific form that outlines your wishes. This form needs to be signed by you in the presence of a notary public. It’s advisable to consult with a legal professional to ensure that the document meets all legal requirements and accurately reflects your intentions.

What powers can be granted to an agent in a Durable Power of Attorney?

You can grant your agent broad or limited powers. Common powers include managing bank accounts, paying bills, handling real estate transactions, and making investment decisions. Be specific about what powers you wish to grant to avoid confusion later on.

Can I revoke a Durable Power of Attorney once it is created?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To revoke, you should create a written document stating your intention to revoke the previous Power of Attorney and notify your agent and any relevant institutions. It’s wise to keep a copy for your records.

What happens if I become incapacitated and do not have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney in place, your loved ones may need to go through a court process to obtain guardianship. This can be time-consuming and costly. Having a Durable Power of Attorney helps avoid this situation by allowing your chosen agent to act on your behalf immediately.

Is a Durable Power of Attorney only for financial matters?

No, while a Durable Power of Attorney primarily focuses on financial matters, you can also include provisions for health care decisions if you wish. However, for health care decisions specifically, it is often recommended to create a separate document called a Health Care Proxy.

Do I need to file my Durable Power of Attorney with the court?

No, in New York, you do not need to file your Durable Power of Attorney with the court. However, it’s a good idea to keep the document in a safe place and provide copies to your agent and any financial institutions where you have accounts.

Can I use a Durable Power of Attorney created in another state in New York?

Generally, a Durable Power of Attorney created in another state may be recognized in New York, but it’s important to ensure it complies with New York laws. Consulting with a legal professional can help clarify if any additional steps are necessary to ensure its validity.

What should I consider before choosing an agent for my Durable Power of Attorney?

When selecting an agent, consider their reliability, trustworthiness, and ability to handle financial matters. It's also wise to discuss your wishes and expectations with them beforehand. This can help ensure they understand your preferences and are prepared to act in your best interest.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone else to manage their financial affairs, even if they become incapacitated. |

| Governing Law | The New York Durable Power of Attorney is governed by New York General Obligations Law, Article 5, Title 15. |

| Durability | This form remains effective even if the principal is unable to make decisions due to illness or disability. |

| Agent Authority | The appointed agent can handle a variety of financial matters, including banking, real estate transactions, and tax matters. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent. |

| Signature Requirements | The form must be signed by the principal and acknowledged by a notary public to be legally valid. |

| Limitations | Certain powers, such as making medical decisions, cannot be granted through a Durable Power of Attorney; a separate document is needed for healthcare decisions. |

Common mistakes

Filling out a Durable Power of Attorney form in New York can seem straightforward, but many people make common mistakes that can lead to complications later on. One frequent error is not clearly identifying the agent. It's essential to name someone trustworthy who understands your wishes. If you use vague language or leave this section blank, it could create confusion about who has the authority to act on your behalf.

Another common mistake is failing to specify the powers granted to the agent. The form allows you to outline specific powers, such as managing finances or making healthcare decisions. Leaving this section too broad or not detailing the powers can lead to misunderstandings. Your agent might assume they have more authority than intended, or they may not feel confident making decisions without clear guidance.

Many individuals also overlook the importance of signing and dating the document correctly. In New York, the Durable Power of Attorney must be signed in the presence of a notary public. Skipping this step or not having the document properly notarized can render it invalid. Always double-check that your signature is dated and that the notary has completed their part as required.

Finally, people often forget to discuss their decisions with their chosen agent. It’s crucial to have an open conversation about your wishes and the responsibilities involved. Without this discussion, the agent may not fully understand your preferences or may feel unprepared to act when the time comes. Clear communication can prevent potential conflicts and ensure that your intentions are honored.

Other Common State-specific Durable Power of Attorney Forms

Power of Attorney Form Pa - This document is a vital component of any comprehensive estate plan and should not be overlooked.

To facilitate a smooth real estate transaction, it's crucial to understand the intricacies of the Real Estate Purchase Agreement, commonly utilized as a standard contract in many deals. For more information on this important legal document, visit the official Real Estate Purchase Agreement resource.

North Carolina Durable Power of Attorney Form Pdf - Protect your wishes regarding medical care with the right instructions.

Texas Durable Power of Attorney Free Pdf - Creating a Durable Power of Attorney may involve conversations about sensitive topics, but it’s a necessary step.