Loan Agreement Document for New York State

Things You Should Know About This Form

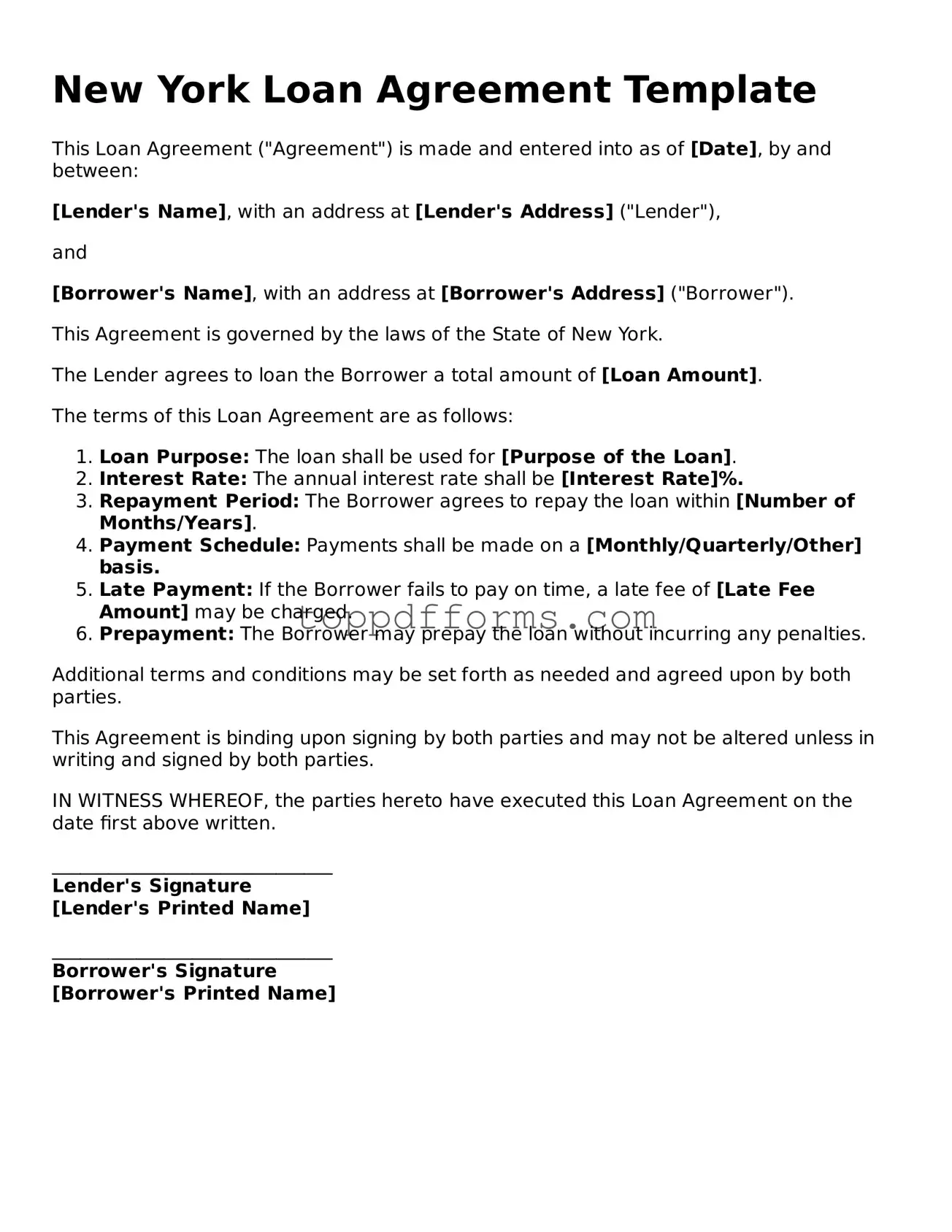

What is a New York Loan Agreement form?

A New York Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is provided in the state of New York. It serves to protect both the lender and the borrower by clearly defining the obligations and rights of each party involved in the loan transaction.

Who can use a New York Loan Agreement form?

Any individual or entity looking to lend or borrow money in New York can utilize this form. This includes personal loans between friends or family, as well as business loans between companies. It is important for both parties to understand the terms before signing the agreement.

What key components should be included in the form?

A comprehensive New York Loan Agreement should include several key components: the names of the parties involved, the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it should specify the consequences of default and any applicable fees.

Is it necessary to have the agreement notarized?

While it is not strictly required to have a New York Loan Agreement notarized, doing so can provide an extra layer of protection. Notarization helps verify the identities of the parties and ensures that the agreement was signed voluntarily, which can be beneficial in case of disputes.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take specific actions as outlined in the agreement. This may include demanding immediate repayment, charging late fees, or taking legal action to recover the owed amount. The exact consequences should be clearly detailed in the agreement to avoid misunderstandings.

Can the loan agreement be modified after it is signed?

Yes, a loan agreement can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

Are there any legal requirements specific to New York?

New York has certain regulations that may affect loan agreements, particularly concerning interest rates and consumer protections. Lenders must comply with state usury laws, which limit the amount of interest that can be charged. It is wise to review these regulations or consult a legal expert to ensure compliance.

What should I do if I have a dispute regarding the loan?

If a dispute arises, the first step is to review the loan agreement to understand the terms and conditions. Many agreements include a clause for dispute resolution, such as mediation or arbitration. If these methods do not resolve the issue, seeking legal advice may be necessary to explore further options.

Can I use a template for the New York Loan Agreement form?

Using a template can be a helpful starting point for creating a New York Loan Agreement. However, it is essential to customize the template to fit the specific terms of the loan and the needs of both parties. Consulting with a legal professional can help ensure that the agreement is comprehensive and compliant with state laws.

Where can I find a New York Loan Agreement form?

New York Loan Agreement forms can be found online through various legal document websites, or they may be available at local legal offices. It is important to choose a reputable source and ensure that the form is up-to-date and compliant with New York laws.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | The New York Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York. |

| Key Components | It typically includes the loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding. |

| Dispute Resolution | The agreement may specify how disputes will be resolved, often through mediation or arbitration. |

Common mistakes

Filling out the New York Loan Agreement form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is failing to provide accurate personal information. This includes names, addresses, and Social Security numbers. Inaccuracies can cause problems down the line, especially during the approval process.

Another mistake is not reading the entire document carefully. Many individuals skim through the terms and conditions, missing important details about interest rates, repayment schedules, and fees. This oversight can lead to misunderstandings and financial strain later on.

Some people neglect to include all required signatures. Each party involved in the agreement must sign the document for it to be valid. Missing a signature can render the entire agreement unenforceable, which can create significant issues when it comes time to repay the loan.

Additionally, failing to specify the loan amount is a common error. It’s crucial to clearly state how much money is being borrowed. Ambiguities in this area can lead to disputes and confusion, making it essential to be precise.

Another mistake is not including the purpose of the loan. Lenders often want to know why the funds are being requested. Providing a clear purpose can help build trust and facilitate the approval process.

Some borrowers forget to review the repayment terms. It’s important to understand when payments are due and the consequences of late payments. Ignoring this can lead to financial penalties and damage to credit scores.

People also sometimes fail to disclose existing debts. Lenders need a complete picture of a borrower's financial situation. Not being transparent about other obligations can lead to complications in the approval process.

Another common error is overlooking the importance of having a co-signer. If the borrower has a limited credit history or a low credit score, having a co-signer can improve the chances of loan approval. Not considering this option can limit opportunities.

Finally, many individuals do not keep a copy of the completed agreement. It’s essential to have a record for future reference. Without a copy, borrowers may find themselves in disputes about terms or conditions later on.

Other Common State-specific Loan Agreement Forms

Promissory Note Georgia - Provisions to address unexpected financial hardships may be included.

Loan Note Template - May include a covenant requiring the borrower to maintain certain financial ratios.

Promissory Note Template Illinois - An understanding of the Loan Agreement can foster a positive lender-borrower relationship.

When seeking to secure a rental property, filling out a Rental Application form accurately is crucial, as it allows landlords to assess your suitability as a tenant. To simplify the process, you can access helpful resources and templates, such as those available at PDF Templates, which guide you in providing all necessary information effectively.

Sample Promissory Note California - It’s essential to understand the total repayment amount over time.