Quitclaim Deed Document for New York State

Things You Should Know About This Form

What is a Quitclaim Deed in New York?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike a warranty deed, it does not guarantee that the property is free from liens or other claims. The person transferring the property, known as the grantor, simply gives up any claim they may have to the property. This type of deed is often used in situations such as divorce, inheritance, or when property is being transferred between family members.

Who typically uses a Quitclaim Deed?

Individuals often use Quitclaim Deeds in various situations. Common scenarios include transferring property between family members, adding or removing someone from the title, and settling estate matters. They are particularly useful when the parties involved trust each other and do not require the guarantees that come with other types of deeds.

What information is needed to complete a Quitclaim Deed?

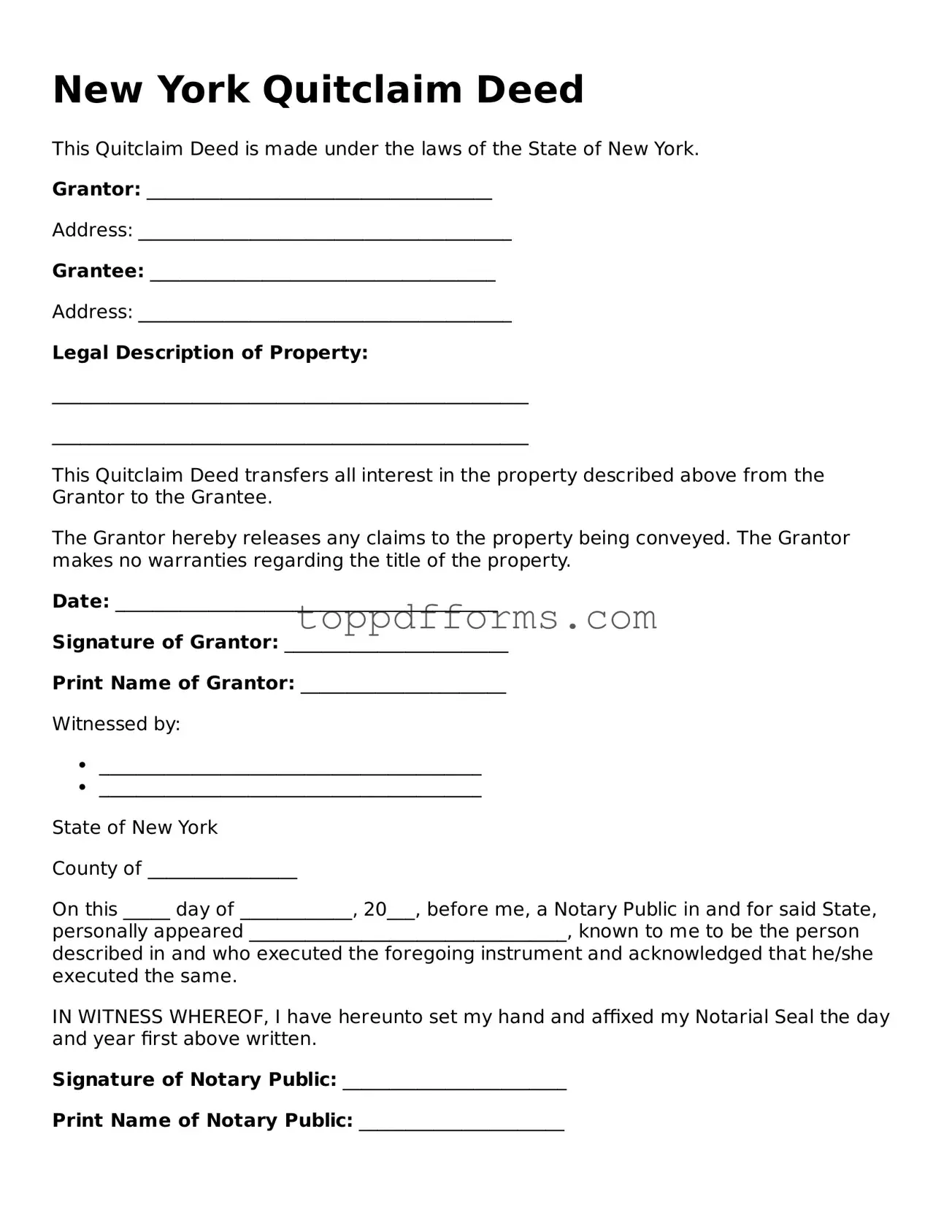

To complete a Quitclaim Deed, you will need several key pieces of information. This includes the names and addresses of both the grantor and the grantee, a legal description of the property, and the date of the transfer. Additionally, it is important to include the signature of the grantor, and the deed may need to be notarized to be legally binding.

Do I need a lawyer to prepare a Quitclaim Deed?

While it is not legally required to have a lawyer prepare a Quitclaim Deed, it is often advisable. A lawyer can help ensure that the deed is filled out correctly and meets all legal requirements. This can prevent potential disputes or issues in the future. If you are unsure about the process or have specific concerns, consulting with a legal professional can be beneficial.

How do I file a Quitclaim Deed in New York?

To file a Quitclaim Deed in New York, you must first complete the deed form. Once completed, the deed should be signed by the grantor in the presence of a notary public. After notarization, the deed must be filed with the county clerk's office in the county where the property is located. There may be a filing fee, so it is wise to check with the local office for specific requirements.

Are there any tax implications when using a Quitclaim Deed?

Yes, there can be tax implications when transferring property with a Quitclaim Deed. While the transfer itself may not trigger a tax, it is important to consider potential gift tax implications if the property is transferred without receiving fair market value in return. Additionally, the grantee may need to reassess property taxes based on the new ownership. Consulting a tax professional can help clarify any concerns.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. The grantor cannot simply change their mind after the deed is recorded. However, if both the grantor and grantee agree, they can execute a new deed to reverse the transaction. It is important to follow proper legal procedures to ensure the new deed is valid.

What happens if there are liens on the property?

If there are liens on the property, a Quitclaim Deed does not remove them. The grantee assumes any existing liens or claims against the property once the transfer is made. It is crucial for the grantee to conduct a title search before accepting a Quitclaim Deed to understand any potential issues that may affect ownership.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides certain guarantees about the property, including that the grantor has the right to transfer ownership and that the property is free from encumbrances. In contrast, a Quitclaim Deed simply transfers whatever interest the grantor has in the property, with no warranties or guarantees. This makes Quitclaim Deeds riskier for the grantee.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. It simply conveys whatever interest the grantor has in the property. |

| Governing Law | The New York Quitclaim Deed is governed by the New York Real Property Law, specifically Sections 244 to 258. |

| Usage | This form is often used between family members or in situations where the parties know each other well, as it does not provide title insurance. |

| Filing Requirements | After execution, the deed must be filed with the county clerk's office in the county where the property is located to be effective. |

Common mistakes

Filling out a New York Quitclaim Deed form can be a straightforward process, but mistakes are common. One frequent error is failing to provide complete and accurate information about the property. This includes the legal description, which must be precise. Omitting details or using vague descriptions can lead to complications in the transfer of ownership.

Another common mistake is neglecting to include the names of all parties involved. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. If any party's name is missing or incorrectly spelled, it can invalidate the deed.

Many people also overlook the importance of notarization. A Quitclaim Deed must be signed in front of a notary public to be legally binding. Without proper notarization, the deed may not be recognized by the county clerk’s office, leading to potential disputes or issues with ownership.

In addition, individuals often forget to check the requirements for filing the deed in their specific county. Each county in New York may have its own rules regarding fees, additional forms, or submission processes. Failing to adhere to these requirements can delay the filing or result in rejection.

Some filers mistakenly assume that a Quitclaim Deed is the same as a warranty deed. While both serve to transfer property, a Quitclaim Deed offers no guarantees about the title. Misunderstanding this can lead to unrealistic expectations about the security of the property transfer.

Another pitfall involves the payment of transfer taxes. In New York, certain transfers may be subject to transfer taxes. Failing to calculate and pay these taxes can result in fines or legal complications down the line.

People often neglect to keep copies of the completed Quitclaim Deed. After filing, it is crucial to retain a copy for personal records. This can serve as proof of ownership and is helpful for future transactions or disputes.

Lastly, many individuals do not seek legal advice before completing the Quitclaim Deed. While the form may seem simple, the implications of transferring property can be complex. Consulting with a legal professional can help avoid costly mistakes and ensure that all aspects of the transfer are handled correctly.

Other Common State-specific Quitclaim Deed Forms

How to Do a Quitclaim Deed in Michigan - Common in joint ownership situations, the quitclaim deed allows one co-owner to transfer their share to another.

This form is an important legal instrument for landlords and includes the necessary Notice to Quit steps to initiate proper tenant notification, ensuring all procedures are followed effectively within the state of Colorado.

Florida Quit Claim Deed Filled Out - These forms can provide a way to resolve ownership ambiguities quickly.

Quitclaim Deed Ohio - This deed does not involve any payment for the transfer.